The story of the tax that my wife should know before her retirement.How much will you be drawn from the retirement allowance?(Financial Field) --Yahoo! News

delivery

57コメント57件The story of the tax that my wife should know before her retirement.How much will you be drawn from the retirement allowance?

Do you think you can receive the retirement allowance when your husband retires at your face value?The retirement allowance is charged with income tax and resident tax, as in monthly salaries.So how much is the tax deducted from the retirement allowance?As a story about taxes that my wife should know, this time I will explain the income tax and resident tax deducted from the retirement allowance.

Retirement allowance and its range

Retirement allowance is generally paid separately from the normal salary from the employer due to retirement. It will be paid from your company with the meaning of comfort for many years that has contributed to the company and the meaning of retirement. Since retirement allowances are not legally stipulated, changing jobs has become commonplace, and more and more companies are said to have collapsed lifetime employment. On the other hand, if the retirement allowance is determined in the rules of employment, the employer will be obliged to pay for retirement allowance, as in normal wages. And retirement allowances are treated as retirement income due to tax system. Regarding retirement income, the National Tax Agency's website states that "retirement allowance, temporary salary, and other salaries that are temporarily received and these properties (these are called" retirement allowances "). Specifically, not only retirement benefits received from workplace, but also salaries received from the government due to the dismissal notice and unpaid wage payment system, iDeCo and corporate pension received by lump -sum payment are also applicable to retirement income. To do.

How much tax on retirement income?

The retirement income and the income tax that arise in it are calculated by the original calculation formula separately from the normal salary (salary income).To put it simply, the income tax for retirement income is subtracted from the retirement allowance from the retirement allowance, and the income tax is calculated as a tax part as one -half.

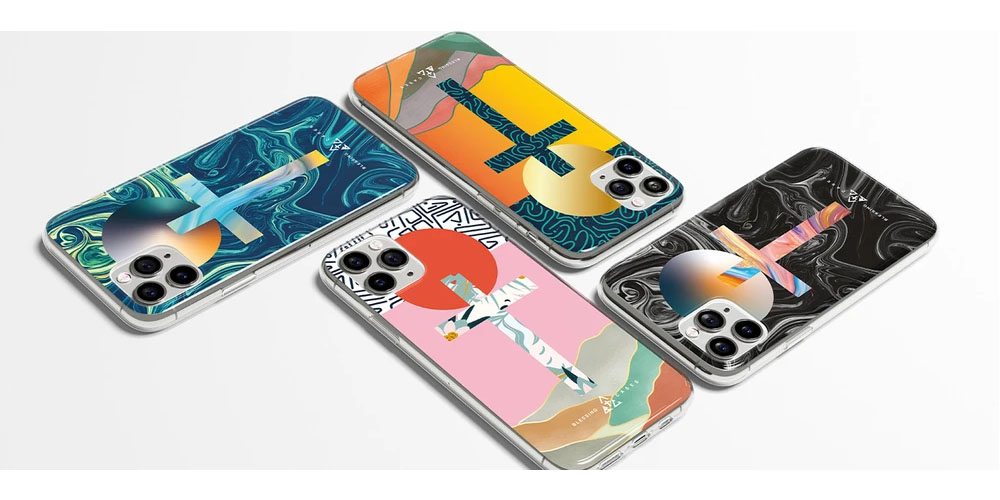

Chart 1

Source: NTA "Tax Answer (Frequently Asked Tax Questions) NO. 1420 退職金を受け取ったとき(退職所得)」 退職金が税制上で優遇されていると時折いわれることがありますが、それはChart 1にある退職所得控除額の存在と、その控除後、さらに2分の1にした金額に税率をかけて所得税が算出される点にあります。では、30年間勤続した方が定年退職して2500万円の退職金を得たと仮定し、退職金にかかる所得税を計算してみましょう。この場合、勤続年数が20年を超えているので退職所得控除額は下記となります。 ・800万円+70万円×(30年-20年)=1500万円 支給される退職金から上記の退職所得控除額を差し引いた課税退職所得は、下記のとおりです。 ・2500万円-1500万円×2分の1=500万円 この500万円に対して所得税がかかるため、20%の所得税率を乗じて控除額を差し引いた所得税は下記の金額になります。 ・500万円×20%-42万7500円=57万2500円 復興特別所得税も加えると、所得税全体の金額は下記となります。 ・57万2500円+(57万2500円×2.1%) = 584,522 yen The retirement allowance is not only income tax but also resident tax.Resident tax is 500,000 yen because it is taxed at a tax rate of 10%to the taxable income amount (in this example, 5 million yen in tax retirement income).In the case of office workers, the resident tax is usually paid the following year when the income was incurred, but it is deducted at the time of payment only for retirement benefits.In other words, even if you receive a retirement allowance of 25 million yen, the amount of income tax and resident tax will be 23,915,478 yen.

次ページは:退職所得にかかる税金はどう納めるの?Page 1/2

最終更新:ファイナンシャルフィールド