Which is better if you choose Rakuten Card?Explain recommended cards and reasons | Wealth Bridge

I will explain which of the Rakuten cards to choose, the recommendation and the reason.In addition, we will also introduce the features of various cards, points to note when using, and comparison of points redemption rate with other companies' cards.Please refer to those who are considering credit cards from now on.

table of contents

- One of the must -have Rakuten users!What are the various types of Rakuten cards?

- Features of 11 kinds of Rakuten cards

- If you get lost in the status of the card, check here!

- Compare Rakuten cards with other companies' high reduction rates

- Flow of Rakuten Card application

- Most Rakuten cards can have 2 cards

- Precautions for using Rakuten cards

- Recommended Rakuten Card Q & A

- Rakuten cards are also examined based on their characteristics and have two cards.

One of the must -have Rakuten users!What are the various types of Rakuten cards?

(画像=Wealth Bridge編集部)Why is Rakuten Card popular?

Rakuten Card has won the amazing 13th consecutive credit card industry in customer satisfaction surveys.Another reason is that there is a great point system unique to Rakuten users.

Rakuten Card is a credit card used by many users, boasting high customer satisfaction and more than 24 million card issues.Here are some of the great deals of Rakuten Cards, which have been supported by users for 13 consecutive years.

Rakuten Cards have won the number one customer satisfaction in the number of credit card industries in the largest customer satisfaction survey in Japan for 13 consecutive years.In addition, 2021 is the first in "cost performance" and "future reuse".

As of October 2021, the number of Rakuten cards has exceeded 24 million, and the annual credit shopping handling volume in 2020 is 11..You can see that it is supported and used by many users, such as achieving 6 trillion yen.

As of January 2022, 25 types (including design differences) were issued, but among them, the annual membership fee is "Rakuten Gold Card", "Rakuten Premium Card", "Rakuten Black Card", "Rakuten ANA".There are only four types of Mileage Club Card.Others are all free for many years.

For those who need a credit card that can easily use and earn points more easily than a card with a substantial service, it is nice to be free of the annual membership fee that is not costly.

Rakuten Card has a normal point redemption rate of 1.It is set to 0 % higher.There are various points that can be accumulated by using a credit card, such as what can be obtained in special campaigns in addition to normal points.However, for those who usually use credit cards and want to accumulate many points, the usual points are usually 1.It can be said that there is a great advantage to 0 %.

Another advantage of Rakuten Card is that there are many "special offers", which usually give more points than normal points.This can be used in the Rakuten Card Point Plus service, and if you use a card after entering from a list of preferential stores, you will earn more points than normal points.

Rakuten Cards are advantageous because they accumulate points for "Rakuten Pay" or "Rakuten Edy".1 of the amount paid to Rakuten Card.Up to 1 with Rakuten Pay after giving 0 % points..5 %, up to 1 in Rakuten Edy.Points of 0 % (when charged from Rakuten card) will be given.

Rakuten Pay can easily pay with a smartphone by downloading the app.Rakuten Edy can be used to create a card, charge the Edy card and pay.

Features of 11 kinds of Rakuten cards

(画像=Wealth Bridge編集部)There are various types of Rakuten cards, what is different?

The annual membership fee, the point reduction rate, the available amount, and the international brand corresponding.In addition, Rakuten cards have services and insurance, but the contents vary depending on the card.In particular, cards with high annual membership fees are available in a wide variety of services.

It is a good idea to choose a suitable service content depending on how you use Rakuten cards.Here we compare the features of 11 types of cards.* The campaign content in the sentence is as of February 22, 2022.

| 楽天カード | 楽天ゴールドカード | 楽天プレミアムカード | 楽天PINKカード | 楽天銀行カード | 楽天ANAマイレージクラブカード | 楽天カードアカデミー | アルペングループ楽天カード | 楽天カードみちのく銀行デザイン | 楽天カードゆうちょ銀行デザイン | 楽天ブラックカード | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 年会費 | 永年無料 | 2,200円(税込) | 1万1,000円(税込) | 永年無料 | 永年無料 | 550円(税込)※初年度無料 | 永年無料 | 永年無料 | 永年無料 | 永年無料 | 3万3,000円(税込) |

| ポイント還元率 | 1.0〜3.0% | 1.0〜4.0% | 1.0〜5.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜3.0% | 1.0〜5.0% |

| 国際ブランド | VISA/Mastercard/JCB/AMERICAN EXPRESS | VISA/Mastercard/JCB | VISA/Mastercard/JCB/AMERICAN EXPRESS | VISA/Mastercard/JCB/AMERICAN EXPRESS | JCB | VISA/Mastercard/JCB | VISA/JCB | Mastercard | Mastercard | VISA/Mastercard | VISA/Mastercard/JCB/AMERICAN EXPRESS |

| 追加カード | ETCカード/家族カード | ETCカード/家族カード | ETCカード/家族カード | ETCカード/家族カード | ETCカード | ETCカード/家族カード | ETCカード | ETCカード/家族カード | ETCカード/家族カード | ETCカード/家族カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy | キャッシュカード機能 | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy ※ キャッシング機能は無し | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy | 楽天ポイント/楽天Edy |

* Created the writer based on the Rakuten Card official website (as of February 22, 2022)

(画像=楽天カードより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/Mastercard/JCB/AMERICAN EXPRESS |

| カードデザイン | 11種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行障害保険(最高2,000万円)※利用付帯 |

Source: Rakuten Card

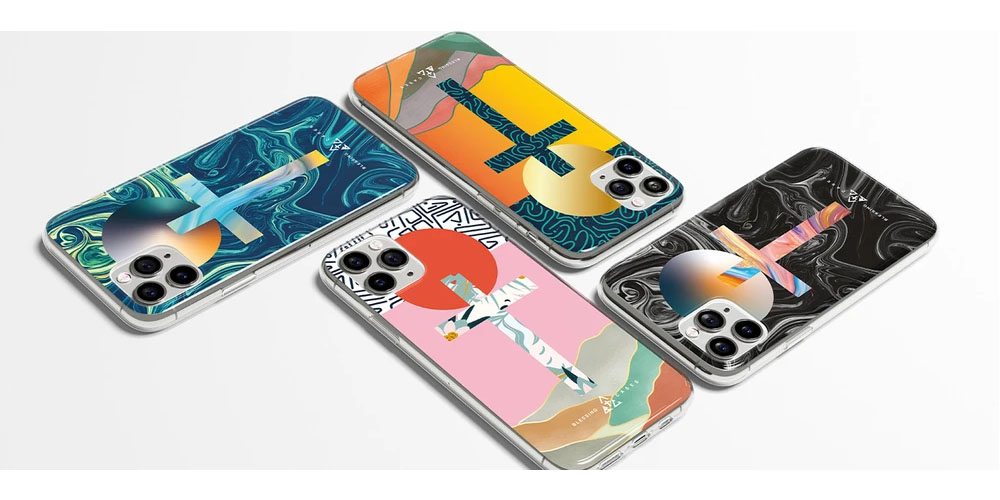

It is a basic credit card that can be easily used with an annual fee for free.You can choose your favorite card from 11 types of designs, and if you already have a card, you can also change the design.

The points accumulated by using the card can be used in shops with Rakuten mark, and can be used for monthly payments.Regarding security measures to be used with peace of mind, there are also a variety of fraudulent detection systems and personal authentication services.

It is the most popular standard card, so it is also recommended for credit card beginners.It also comes with the same functions and features as other cards, such as high points reduction rate and overseas travel insurance.It is also attractive that you can get 5,000 points by subscribing.

楽天カードのお申し込みはこちら(画像=楽天ゴールドカードより引用)| 年会費 | 2,200円(税込) |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜4.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/Mastercard/JCB |

| カードデザイン | 1種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行障害保険(最高2,000万円)※利用付帯/海外・国内空港ラウンジの利用/トラベルデスクの無料利用 |

Source: Rakuten Gold Card

Rakuten Gold Card is a higher -grade status of Rakuten cards.There are benefits that you can use domestic airports and some overseas airport lounges up to twice a year, and use travel desks for free.In addition, ETC cards can be used for free annual membership fee.

A card with a function that allows you to automatically pay the fee without stopping payment at the counter at the tollgate when you invade the highway.

It is also attractive that you can get 7,000 points by new enrollment and use.There is also a service that gives points 1 times as a birth month service, and you can get a 2,000 yen discount coupon that can be used for Rakuten Travel.

Rakuten Gold Cards can use domestic airport lounges twice a year, so it is recommended for those who want to enjoy domestic travel.In the lounge, you can spend a relaxing time on the sofa, and drinks and snacks are also available.You will be satisfied because you can spend a special time.

楽天ゴールドカードのお申し込みはこちら(画像=楽天プレミアムカードより引用)| 年会費 | 1万1,000円(税込) |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜5.0% |

| SPUポイント倍率 | +4倍 |

| 国際ブランド | VISA/Mastercard/JCB/AMERICAN EXPRESS |

| カードデザイン | 1種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高5,000万円)※自動付帯4,000万円、利用付帯1,000万円/国内旅行傷害保険(最高5,000万円)※自動付帯/動産総合保険(最高300万円)/海外・国内空港ラウンジの利用/3種類の優待サービス |

Source: Rakuten Premium Card

It is a card with a lot of services for overseas travel, such as travel accident insurance and lounge use.You can earn 8,000 points by new enrollment and use.

With Rakuten Premium Card, you can choose your favorite from three special treatment services.The Rakuten Ichiba Course is 6 times the point of "Premium Card Day" on Tuesday and Thursday, and the "Travel Course" has tripled points for Rakuten Travel.In "Entertainment Course", points will be added 1 times by using Rakuten TV and Rakuten Books.

Rakuten Premium Card is recommended for those who use international flights a lot.The reason is that you can attach a "Priority Pass (annual membership fee of $ 429)" for free and unlimited overseas airport lounge services.This allows you to spend more than 1,300 airport lounges in 148 countries around the world.

(画像=楽天PINKカードより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/Mastercard/JCB/AMERICAN EXPRESS |

| カードデザイン | 4種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円)※利用付帯/「楽天PINKサポート」など選べるサービス(月額料金あり) |

Source: Rakuten PINK card

Rakuten Pink Card is a female card designed based on pink.It is characterized by being able to choose your favorite from four different designs and high customization that can accompany your favorite services.For designs with illustrations of Mickey Mouse and Minnie Mouse, international brands can only select JCB.

Customized services include insurance for women who are limited to Rakuten PINK cards.The monthly insurance premiums will be charged, but it is recommended for those who are considering insurance in the future.Points are up to three times in Rakuten Ichiba and up to doubled in Rakuten Travel.

Rakuten Pink Card has a variety of benefits for women.Because you can customize the incidental service, "Rakuten Group Special Service" (Discount Coupons and Rakuten Points), "Lifestyle Support Service" (discounts and preferential benefits of more than 110,000 such as restaurants and movie tickets), and "Women)You can choose "insurance for" as needed (monthly service fee will be charged).

楽天PINKカードのお申し込みはこちら(画像=楽天銀行カードより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍(楽天銀行から引き落とす場合はさらに+1倍) |

| 国際ブランド | JCB |

| カードデザイン | 1種類 |

| 追加カード | ETCカード |

| 付帯機能 | キャッシュカード機能 |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円) ※利用付帯 |

Source: Rakuten Bank Card

You can earn 5,000 points by new enrollment and the use of credit functions.Since the credit card has a cash card function, it is a convenient card that allows you to draw a cash or pay a card with one card.

Also, if there is a withdrawal for the use of Rakuten cards on the 27th of each month, the Rakuten Bank deposit rate will be doubled the following month.If you enter the "Happy Program", you can also use the bonus for which Rakuten points accumulate 3 to 9 points every month.

The Rakuten Bank Card has a point redemption rate by using Rakuten Bank as a cash deduction account for use on Rakuten Ichiba..It increases to 0 %.Therefore, this card is recommended for those who have a Rakuten Bank account.

(画像=楽天ANAマイレージクラブカードより引用)| 年会費 | 550円(税込)※初年度は無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/Mastercard/JCB |

| カードデザイン | 2種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円)※利用付帯/ANAマイレージクラブ機能 |

Source: Rakuten ANA Mileage Club Card

Rakuten ANA Mileage Club Card is a card with ANA mileage function.You can choose either "Mile" or "Rakuten Point".Those who have a mileage club card can accumulate a single mileage account.

In addition to using cards at Rakuten Ichiba, points will be up to tripled, and you will earn up to twice as much as Rakuten Travel.By joining the Rakuten ANA Mileage Club Card and using the card, a bonus gift worth up to 5,000 yen will be given.

If you are accumulating miles, we recommend Rakuten ANA Mileage Club Card.You can get mileage instead of Rakuten points even in regular shopping, and you can exchange 2 points = 1 miles of the accumulated Rakuten points.However, note that the points earned in the campaign cannot be exchanged for miles.

(画像=楽天カードアカデミーより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/JCB |

| カードデザイン | 1種類 |

| 追加カード | ETCカード |

| 付帯機能 | 楽天ポイント/楽天Edy ※ キャッシング機能は無し |

| サービス・保険 | 楽天学割/海外旅行傷害保険(最高2,000万円) ※利用付帯 |

Source: Rakuten Cardアカデミー

Rakuten Card Academy can apply if you are 18 to 28 years old (excluding high school students), and students will automatically switch to the normal "Rakuten Card" if you graduate.Automatic "Rakuten student discount (targeting 15 to 25 years old)" will continue to be qualified even if you leave Rakuten Card Academy.

You can earn points worth 5,000 yen by new enrollment and card use.As a privilege limited to Rakuten Card Academy, points are up to four times when using cards in Rakuten Books, and points by using cards on Rakuten Travel are up to triples.

Rakuten Card Academy is recommended for students.Rakuten grades that can be used in various scenes in student life are attached, and points are accumulated at a great deal by using cards accompanying books and traveling.

(画像=楽天カードより引用)(画像=アルペングループ楽天カードより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | Mastercard |

| カードデザイン | 1種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy/アルペンポイント機能 |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円)※利用付帯/アルペングループ特典 |

Source: Alpine Group Rakuten Card

Alpine Group Rakuten Card can be applied by registering with "Alpine Group Members".As an enrollment privilege, Rakuten points and alpine points are given 1,000 points, respectively.

This card features both Rakuten points and alpine points.First of all, 1 for the use of Rakuten cards.0 %, 0 for the use of Rakuten point card.5 %, and 5 alpine points.0 % and maximum 6.5 % will be granted.

In addition, you can receive various benefits by using Alpine Group stores and related facilities.

It is a card that can accumulate points large if used at the Alpine Group store, so it is a recommended card for those who purchase sports equipment a lot.In addition, you can receive discounts such as being able to receive discounts when purchasing sports equipment and discounts on processing costs.

(画像=楽天カードみちのく銀行デザインより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | Mastercard |

| カードデザイン | 1種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円) |

Source: Rakuten Cardみちのく銀行デザイン

You will receive a 5,500 yen Rakuten point by opening a new member, using a card, and opening the "Michinoku Bank" account.The basic function is the same as "Rakuten Card", but the only international brand is "MasterCard".

Michinoku Bank's cache function is not attached.The difference from Rakuten cards is the design and the international brand that can be selected.MasterCard can be settled, so it is recommended for those who want to pay quickly.

Note that Rakuten Card Michinoku Bank Design has the same basic functions as a normal Rakuten card, and there is no cash card function.If you already have a Michinoku bank account, it is recommended that you specify the Michinoku bank account for the account transfer at the time of application, as you will receive 500 Rakuten points.

(画像=楽天カードゆうちょ銀行デザインより引用)| 年会費 | 永年無料 |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜3.0% |

| SPUポイント倍率 | +2倍 |

| 国際ブランド | VISA/Mastercard |

| カードデザイン | 2種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高2,000万円) |

Source: Rakuten Cardゆうちょ銀行デザイン

Rakuten Card Japan Post Bank Design has the same function as the normal "Rakuten Card".It is based on Japan Post Bank color, and the Japan Post Bank logo is designed.In addition, there is a "Rakuten Card Shopping Panda" designed.

Note that Rakuten Japan Post Bank design does not have a cash card function.Therefore, if you have a Japan Post Bank account, be careful not to confuse it because the design is similar to Japan Post Bank's cash card.

If you have a Japan Post Bank account, you can get 500 Rakuten points by setting a Japan Post Bank account held in the card transfer account.The end of the campaign is undecided, so it is recommended for those who have a Japan Post Bank account.

| 年会費 | 3万3,000円(税込) |

|---|---|

| 利用可能額 | - |

| ポイント還元率 | 1.0〜5.0% |

| SPUポイント倍率 | +4倍 |

| 国際ブランド | VISA/Mastercard/JCB/AMERICAN EXPRESS |

| カードデザイン | 1種類 |

| 追加カード | ETCカード/家族カード |

| 付帯機能 | 楽天ポイント/楽天Edy |

| サービス・保険 | 海外旅行傷害保険(最高1億円)/国内旅行傷害保険(最高5,000万円)/動産総合保険(300万円)/海外・国内空港ラウンジの利用 |

Rakuten Black Card is the highest rank of Rakuten Card.It is not possible to apply directly, and it is an invitation system.The conditions for getting an invitation are not specified on the official website.

Although the annual membership fee is as high as 33,000 yen (tax included), the service that matches it is substantial.There are concierge services by specialized staff and local travel desks overseas, and using airport lounges in 148 airports in 148 countries as well as domestic airports.

Rakuten Black Card is not issued by anyone, so there is a special feeling that only the selected person has.There are many useful services, especially for those who often go abroad, so we recommend that you consider applying when you receive an invitation.

If you get lost in the status of the card, check here!

There are many types of Rakuten cards, so I don't know which one to choose.

Each has different characteristics, so if you know how to use it, you can choose the best one.First, understand the characteristics of the card and determine which is useful for you.

Here, comparing "Rakuten Card and Rakuten Gold Card", "Rakuten Gold Card and Rakuten Premium Card", "Rakuten Premium Card and Rakuten Black Card", we will explain in detail which one is recommended.

(画像=Wealth Bridge編集部)First of all, I will explain what kind of person who recommends "Rakuten Gold Card" rather than the standard card "Rakuten Card".

If you want to spend a relaxing time or want to work on a computer before boarding the aircraft, you'll want to use the airport lounge.

The Rakuten Gold Card service is that you can use a domestic airport lounge twice a year free of charge.If you have many opportunities to fly and use domestic airport lounges, we recommend Rakuten Gold Cards.

If you have many opportunities to travel abroad, you can use a local travel desk, so we recommend Rakuten Gold Cards.

Travel desk supports various local inquiries.For example, you can ask a travel desk to rent a car or book a hotel locally.Or it can be taught sightseeing information, so it is useful when you want to stop somewhere in your spare time.

You can also consult if you have any trouble, such as lost your passport.If you are traveling abroad, you can use such a convenient travel desk, so we recommend Rakuten Gold Cards.

Rakuten Gold Cards are often recommended for those who want to use ETC cards.If it is a normal Rakuten card, the annual membership fee costs 550 yen including tax, but it is free for Rakuten Gold Cards.The one that can be attached is one ETC card per Rakuten gold card.

If you are a Rakuten ETC card, you will earn 1 Rakuten point for every 100 yen by paying a traffic fee.

(画像=Wealth Bridge編集部)Some people may be wondering whether to choose Rakuten Gold Card or Rakuten Premium Card, which is a higher -class card.Therefore, I will explain what kind of person is recommended by "Rakuten Premium Card" depending on how you use your lifestyle and card.

For those who go abroad every year, we recommend Rakuten Premium Cards, which have a substantial benefits when traveling abroad than Rakuten Gold Cards.

The maximum amount of overseas travel accident insurance is as high as 50 million yen (automatically accompanied: 40 million yen, accompanied by use: 10 million yen), and overseas airport lounges are some airports, while Rakuten Premium.Cards can be used in 1300 or more in 148 countries.This is because the "Priority Pass", which costs a maximum of $ 429 a year, is free.In addition, Rakuten Gold Cards can only be used by domestic and overseas airport lounges twice a year, while Rakuten Premium Cards can be used unlimitedly.

(画像=楽天ビジネスカードより引用)If you want to use Rakuten Business Card, a corporate card as a corporate representative or a sole proprietor, you need to join the Rakuten Premium Card.This is because the Rakuten Business Card is a Card of Rakuten Premium Card.

It is easier to manage expenditures by paying for corporate business expenses instead of individual cards, making it easier to manage expenditures and help accounting.Rakuten Business Cards will be used at Rakuten Ichiba, with up to 5 % points.

楽天 ビジネスカードのお申し込みはこちらFor those who have many opportunities to use Rakuten Ichiba and Rakuten Travel, Rakuten Premium Cards are more recommended than Rakuten Gold Cards.

This is a point redemption rate given by Rakuten Ichiba, up to 3 Rakuten Gold Cards..While 0 %, Rakuten Premium Card 5.Because it is 0 %.Furthermore, if you use it on "Specified Premium Card Day" on Tuesday and Thursday, the point is 1.0 % will be added.

Also, if you make an online card payment with Rakuten Travel, you will get 1 point..Since the benefits are substantial, such as 0 % addition, those who use these services are recommended for Rakuten Premium Cards.

(画像=Wealth Bridge編集部)I will explain who Rakuten Black Card, which is the highest rank than Rakuten Premium Card, is recommended.Rakuten Black Card is a fulfilling service content that matches high annual membership fees.Let's check if you can fully enjoy such services.

Like Rakuten Premium Cards, Rakuten Black Cards allow you to use the "Priority Pass" that allows you to use overseas airport lounges for free.The accompanying fee is paid for Rakuten Premium Cards (3,300 yen including tax per person), but up to two Rakuten Black Cards are free.

If you have many opportunities to travel abroad with companions, Rakuten Black Card is recommended because the cost burden of the airport lounge can be reduced.

Rakuten Black Card has a "concierge service" that is not found in Rakuten Premium Cards.

Services provided by concierge desk include "providing and reserving restaurants for travel destinations", "reservations for hotels, air tickets, rental cars in Japan and overseas", and "arrangement of tickets such as concerts, opera appreciation, musicals, etc."。

Compare Rakuten cards with other companies' high reduction rates

(画像=Wealth Bridge編集部)How much is the point of Rakuten Card compared to other companies' cards?

Every company that issues credit cards appeals to the high point redemption rate.Rakuten Cards can accumulate points at a great price by using Rakuten Groups, which are available in various industries.

Credit cards should be as high as possible with point reduction rates.Rakuten Card has a high reduction rate by using Rakuten Group's services, but what about other companies' cards?

Here are the features of five credit cards known as the high reduction rate.

(画像引用=JCB カード Wより引用)JCB CARD W has a normal point redemption rate at 1.Although it is 0 %, points will be doubled to 5 times when using at JCB specialty store.In addition, Starbucks and Mos Burgers are attractive to the high reduction rate, such as increasing 10 times.

In addition, "OKI DOKI Point" stored in JCB CARD W is 1 point = 3 on Amazon..It can be used as 5 yen, so it is a mechanism that can be used at the time of use.

However, you can apply for this card from 18 to 39 years old.If you have a card, you can continue to use it even after the age of 40.

(画像=エポスカードより引用)The Epos Card issued by the Marui Group usually has 0 points.5 %, 1 if you use it in Marui.It is a redemption rate of 0 %.If you make a payment with an Epos card during the Marui bargain period four times a year, you will get 10 % off.

If you make a card online shopping by using the "Epos Point UP Site", the point redemption rate will be doubled at Amazon or UNIQLO, and the other online shops will be 5 to 10 times.Depending on the store, there are cases where the high reduction rate is 30 times higher.

(画像=au PAYカードより引用)The au Pay card issued by au, a mobile phone carrier, has a normal point redemption rate.It is 0 %.Cards can be held even if they are not au users.It will be granted at Ponta points, but if you charge the barcode payment "au pay balance" 0.5 % points will be added.

If you use it at the "Point Up Store", there are benefits that it will increase by 1-2 points per 200 yen.Specifically, there are TOMOD's, Nojima, Starbucks card, Kappa Sushi, Family Restaurant Cocos, etc.Furthermore, at the time of the campaign, points will increase by using it at the target member store.

(画像=ローソンより引用)Lawson Ponta Plus is used in shops other than Lawson and has 1 point redemption rate.It is 0 %.If you use it for "Lawson", "Lawson Store 100" and "Natural Lawson", you will be 1 point plus for 200 yen from midnight to 15:59, and 2 points for 200 yen from 16:00 to 23:59.。

Furthermore, if you pay the card at the above three stores on the 10th and 20th of every month, the point redemption rate is 3..Up to 0 %.

(画像=dカードより引用)The point redemption rate of the d -card provided by DOCOMO is basically 1.It is 0 %.1 by use at a special agency.5-5.A 0 % point is granted.For example, if you pay a card by shopping at Nojima, up to 5.You can receive 0 % reduction (registering "Nojimamo Mobile Member" is required).

The D -point service has a special treatment program called "D Point Program", and when the status rises according to the usage status, the types and numbers that can be used increase.

Flow of Rakuten Card application

(画像=Wealth Bridge編集部)How do I apply for a Rakuten card?

You can easily apply from a personal computer or smartphone.After that, after receiving the enrollment screening, it will be a card issuance if you pass the screening.However, if there is a defect of the documents, it must be submitted again.It takes a long time to issue, so it is important to know the necessary documents and procedures in advance.

I will explain the flow from the application of the Rakuten card to the issue.Know the series of flow so that you can receive the card smoothly.

Rakuten cards can be applied immediately on a personal computer or smartphone.

Let's prepare the necessary documents in advance.What you need to apply for Rakuten Card is Rakuten ID, identity verification document, and bank account number.Rakuten ID can be created by registering to Rakuten member account when applying for Rakuten Card.

What you need as a identity verification document is "driver's license", "passport", or "My Number card".Bank account numbers are required for payment accounts.

Open the official website of Rakuten Card and proceed with "Easy Application".If you select the card to be issued here, enter your personal information, and complete it, you will move to the enrollment screening.

After applying, there will be an enrollment screening.Here, the repayment ability is checked, but the presence or absence of stable income is particularly important.The examination period is short and is completed almost on the same day.

If you pass the screening, a card will be issued in one to 10 days, so the credit card issuance period may be short.

You can check the progress of screening and card issuance on the web page.You will receive "Notice of Application Reception" by e -mail, but if you enter the application reception ID listed there, the date of birth, the last 4 digits of the phone number, you can check it 24 hours a day.

If the card issuance status proceeds to "card delivery", you will be able to check the card shipping status.

Once the Rakuten card is shipped as the examination, it will reach the registered address.The card will not be put in the postal service, but will be received directly by the person.In that case, it is required to present identity verification materials (such as "driver's license", "passport", "My Number card, etc.").

The method of receiving the card depends on the delivery company.If the Japan Post is delivered, the arrival notice arrives first and selects either you receive or receive it at the post office window.In the case of Sagawa Express, the card arrives directly at home.

If you cannot receive it because of the absence, you will need to contact the Rakuten Card Contact Center so that you will be redelivery.

Most Rakuten cards can have 2 cards

Can I have two Rakuten cards for any card?

Basically, it is possible to have the second issue issued by having any card.There is no screening like when the first piece was created.However, if there is any trouble in card use, it may not be issued.Also note that the second card is not issued depending on the type and combination of Rakuten cards.

Rakuten cards can be issued the second card for most cards.Here are the advantages and disadvantages of issuing the second.

(画像=Wealth Bridge編集部)There are exceptions for Rakuten cards, but basically you can have the second card.Therefore, there are various useful use methods such as using properly according to the application.So I will explain what benefits have two Rakuten cards.

Rakuten cards have a variety of designs, so you can have two cards with your favorite design.Depending on your mood, there are some ways to choose the design of the cards you use.

In addition, international brands can be selected from up to four types, so you can choose different ones.Depending on the store, international brands that can be used may be limited.It is convenient because you can use multiple cards in such a case.

Rakuten cards have different services depending on the type, so they can be used properly according to the application.For example, if you often use airports for travel, you can use an airport lounge for free twice a year.If you pay your usual card with another card, you can easily manage payments.

In addition, you can change the application according to the characteristics, such as cards that accumulate more points and cards with a lot of services.

Rakuten cards can be changed to the first card after issuing the second card.Therefore, if you separate the use of two cards, you can do household management separately with each debit account.

For example, one is an account for living expenses, and the other is managed separately as an event or an account for an irregular expense.Convenience can be improved by dividing the Rakuten cards linked to everyday use and expenses for each event.

(画像=Wealth Bridge編集部)I will explain what disadvantages of having two Rakuten cards.In some cases, having the second piece may not have the advantage, and it may only be difficult to manage by increasing the number.

Rakuten cards have different characteristics depending on the type, but weak points are common to each card.In that case, it may not be possible to make up for the weakness with two.For example, except for Rakuten Premium Cards and Rakuten Gold Cards, the annual membership fee for ETC cards costs 550 yen (tax included).If you want to issue an ETC card for free, there is no merit even if you issue two cards with the same grade as a normal Rakuten card.

For the second card, you may want to consider other cards that can make up for the Week Points of Rakuten Card.

Rakuten Cards have an enrollment privilege in which 5,000 points are given for new members, but the second card created is not subject to the benefits.

Also, you need to be careful because you will not receive this benefit even if you cancel the Rakuten card and join again.However, the points earned with the first Rakuten card and the second Rakuten card can be used uniformly.

Rakuten cards can basically make the second card, but depending on the combination, it may not be possible.

First of all, if you have three types of Rakuten Bank Card, Rakuten ANA Mileage Club Card, and Rakuten Card Academy, you cannot issue the second card.Also, if you have a "Rakuten PINK card", you cannot make the same "Rakuten PINK Card" as the second.

In addition, if you have a "Rakuten Gold Card", "Rakuten Premium Card" or "Rakuten Black Card", you cannot issue these three types as the second.

You can check whether the second card can be made from the application form of Rakuten E-NAVI.

Precautions for using Rakuten cards

(画像=Wealth Bridge編集部)Are there any precautions when using Rakuten cards?

Please note that Rakuten points acquired in the campaign have an expiration date.In some cases, points are not given by charge to electronic money.If you call a contact center where you can consult about what you do not understand, it is important to note that even if the mobile phone price plan is "unlimited", a call fee will be charged.

There are some points to keep in mind when using Rakuten cards.There are many opportunities to use it, such as Rakuten points and inquiry services, so be sure to check it out.

ETC cards that can be added with Rakuten Card basically cost 550 yen (tax included).However, in the following cases, the annual membership fee is free.

The Rakuten Card Contact Center allows you to perform various changes in Rakuten cards and consult with the operator.The telephone fee is charged for 10 yen in 20 seconds.Therefore, it is basically recommended to perform the procedure with e-navi.

However, there are cases where you need to contact the contact center because there are problems that cannot be solved from the Internet, such as delinquent charges.Since the telephone number of the contact center is a navigation dial that starts with "0570", call charges will be charged even if the call fee is free.

Rakuten card points include "limited time points" given by the campaign.There are various things that require an entry, and those that automatically participate.It is a campaign point where you can earn points at a great price, but this is a fixed period of use, so you need to be careful.

The expiration date varies depending on the campaign, and if you notice it, it may have expired, so let's manage the points firmly.

In addition, the point of the campaign cannot be exchanged for other points or charged to Rakuten Edy.

Electronic money that can be used with Rakuten Card includes Rakuten Pay and Edy card, but if you charge them, you will earn points.

However, when charging Rakuten Edy with au simple payment, nanaco credit charge, mobile Suica, Smart ICOCA and Mobile PASMO are not eligible for points reduction (charge from Rakuten Pay to Mobile Suica is to be pointed out.)Points are not returned by WAON charge or Family Charge.

From June 2021, Rakuten Card has a point redemption rate for the use of utility bills..It is 2 %.In addition to electricity, gas, and water utility bills, the point redemption rate is 0 for taxes (national tax, prefectural tax, etc.) and national pension insurance premiums..2 %.

This is 1 with another credit card.Considering that there is a 0 % return rate, it can be said that it is a low reduction rate.Of course, those who do not use credit cards for these payments will not be particularly concerned.

Recommended Rakuten Card Q & A

Rakuten cards are also examined based on their characteristics and have two cards.

There are many types of Rakuten cards, but there are differences in the service that can be used and the point redemption rate.Basically, cards with free annual membership fee are attractive because they use the services provided by Rakuten Groups, such as Rakuten Ichiba.

On the other hand, cards that require annual membership fees, which are higher than Rakuten Gold Cards, are enriched for those who travel, such as the use of airport lounges and travel desks.And the higher the rank, the more service content is.Which cards to choose will be determined by the frequency of use of those services.

In addition, you can have two Rakuten cards, so you can combine one high -performance card and one standard card that can efficiently accumulate points.It is recommended to choose two cards with the best combination, taking into account the services of each card and your lifestyle.

| 関連記事 |

|---|

| ・【目的別】おすすめのクレジットカードおすすめ8選と失敗しない選び方を解説・ 【高還元率】クレジットカード8選!選び方や各カードの特徴を徹底解説・マスターカードの魅力は?おすすめ5選と選び方を徹底解説・20代におすすめクレジットカード7選!20代限定のメリットも紹介・イオンカードのメリット・デメリットは?その評判や特徴とあわせて解説 |