A campaign to get a total of 10,000 points by joining and using au Pay cards![Introducing a great deal of use]

The au Pay Card is a credit card with an annual membership fee free (au mobile contract or once a year) and a basic return rate of 1 % (100 yen including tax).

It can be used by people other than au mobile phones, so if you use au Pay code payment, it is advantageous.

The au Pay Card holds a campaign to get 10,000 points by joining and using it with a permanent campaign.

From the following, we will introduce the campaigns and features of the au Pay card.

table of contents

au Pay Card 10,000 Point Campaign Overview

First, it is necessary to meet the two campaign application conditions.

Campaign application conditions

The au Pay Card 10,000 point campaign itself is divided into three parts: "charge to au Pay balance", "card use" and "Publishing utility bill or etc.".

Au Pay Card Join & Use Breakdown

Until the last day of the third month, including the monthly enrollment month, if you charge from au Pay card to au Pay balance, it will be 10 % reduction (10 points per 100 yen).

With a charging of 35,000 yen, the upper limit is 3,500 points.

Until the last day of the third month, including the membership month, those who have applied the above "AU Pay balance" will be 5 % reduction (5 points per 100 yen) by shopping with au Pay cards.。

However, the next use is not eligible.

Use of au Pay cards that are not eligible for benefits

Until the last day of the sixth month, including the membership month, you will receive 3,000 points on the au Pay card "There is a monthly payment of the target utility bill" or "newly issued and used ETC cards".

The monthly payment of the target utility fee is applicable only when the monthly payment is set on the au Pay card.

The target businesses are electricity, water, gas, etc.

The target business can be confirmed on this page.

There is also a method of making an ETC card other than the above.

You can apply at the same time as the au Pay card, but newly issued ETC cards will be charged 1,100 yen (tax included).

However, if you use an ETC card within one year of issuance as a usage privilege, 1,100 yen (tax included) will be deducted from the month after the payment of the first traffic fee.

ETC cards have a free annual fee, so if you use it within one year as described above, it will be actually free.

The campaign itself is held as a permanent campaign (from September 1, 2021).

However, be careful as the conditions for receiving the benefits have a deadline.

The au Pay card is free for the annual membership fee by satisfying any of the following conditions.

If you use it at least once a year for people other than au mobile phones, the annual membership fee will be free.

au Pay card (excluding au Pay Gold Card)

If you join and register the au Pay card, you will not be eligible for the top card's au Pay gold card campaign.

If there is a possibility of upgrading in the future, consider which one to use in advance.

Basic information of au Pay card

| 年会費 | 永年無料 |

| 申込資格 | 満18歳以上(高校生を除く) |

| 基本還元率 | 1%還元(100円につき1ポイント※Pontaポイント) |

| ブランド | VISA、Mastercard |

Features of au Pay card

The au Pay card can be used forever for the annual membership fee, so people other than au mobile phones can join and use.

If you charge the au Pay of the code payment from the au Pay card, you can double the points.

Points double by charging from au Pay card to au Pay

If it is a Ponta point partner store, you can present a Ponta point card before the accounting, and then pay with the charged au Pay.

There are many places that can be used in Ponta Point partner stores, such as "Lawson", "Kentucky", and "Geo".

Pontaポイント提携店やサービスはこちらThe point -up shop is a great deal that accumulates points for every 200 yen for the use of au Pay prepaid cards, au Pay cards, and au Pay (code payment).

Check which payment method is eligible.Also, the number of points up varies depending on the store.

| セブン-イレブン | 200円毎にPontaポイント1P増量 | au PAY(コード支払い)が対象 |

| イトーヨーカドー | 200円毎にPontaポイント1P増量 | au PAY(コード支払い)が対象 |

| Tomod’s(トモズ) | 200円毎にPontaポイント2P増量 | au PAYプリペイドカード、au PAYカード、au PAY(コード支払い)が対象 |

| スターバックス カード | 200円毎にPontaポイント3P増量 | au PAYプリペイドカード、au PAYカードが対象 |

| かっぱ寿司 | 200円毎にPontaポイント2P増量 | au PAYプリペイドカード、au PAYカードが対象 |

| TOHOシネマズ | 200円毎にPontaポイント2P増量 | au PAYプリペイドカード、au PAYカードが対象 |

| 紀伊國屋書店 | 200円毎にPontaポイント2P増量 | au PAYプリペイドカード、au PAYカードが対象 |

At a point -up store where you can't use au Pay cards, please charge and use au Pay.

上記以外の特典対象の店舗はこちらIf you use an au Pay card at the au Pay market, you can receive 6 % points (February 2022).

* The return rate varies depending on the campaign.

Au Pay's basic redemption rate is 1 %, and by selecting and using the au Pay payment method, it becomes + 5 %, resulting in a total of 6 % points.

Also, if the stage goes up according to the usage status of au's target service, up to 18 % reduction can be increased.

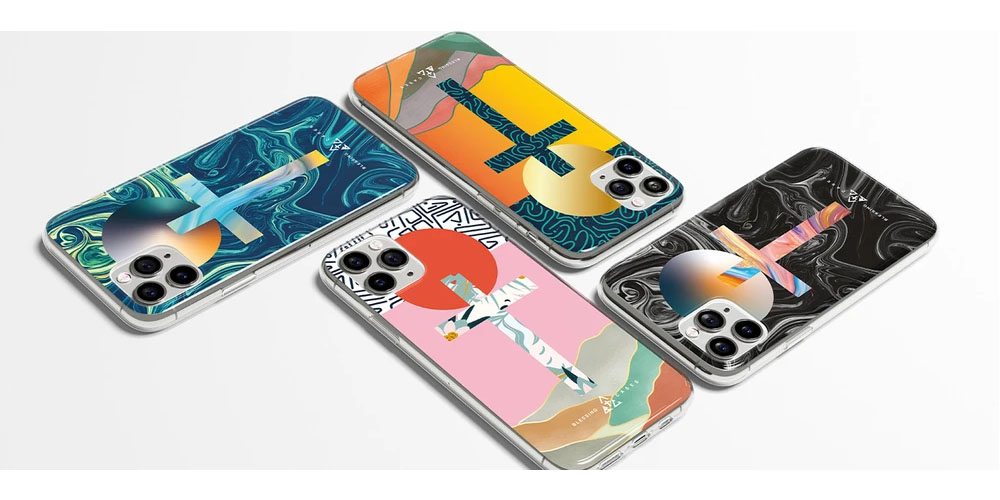

au PAYマーケットはこちらImage source: au Pay card