A must-have item for au users! A thorough explanation of the appeal of the au PAY card

The au PAY card is a high-return rate card that earns 1% points for regular shopping. For those who use au services, the annual membership fee is free, so it can be said that it is a very advantageous must-have item for au users.

Since May 2020, it has become available for non-au users, so there are many people who are concerned about the au PAY card.

In this article, we will introduce the basic information of the au PAY card, the advantages and disadvantages, and thoroughly explain how to save and use points. Not only au users, but also those who are not, please use it as a reference for choosing a credit card that is profitable and smart.

Contents

- 1. The au PAY card is a convenient card with a high return rate! A must-have item for au users even more deals

- 2. What are the features of the au PAY card?

- 2-1. Basic information about au PAY card

- 3. Who is recommended for au PAY card?

- 4. Benefits of au PAY Card

- 4-1. No annual fee for service users

- 4-2. Easy-to-use 100 yen Ponta points Earn 1 point for each transaction

- 4-3. Recharge au PAY with 1.5% return rate

- 4-4. Up to 16% when shopping at au PAY Market Point reduction

- 4-5. Points are always 1.5% or more at point-up stores

- 4-6. Points can be increased by paying mobile and utility bills

- 4-6. li>

- 4-7. Family cards and ETC cards can be created for free

- 4-8. Plenty of incidental insurance

- 4-9. Convenient members Dedicated site available

- 4-10. Easy management with au PAY app

- 5. Disadvantages of au PAY card

- 5-1. Touch payment is not supported

- 5-2. Non-au users will be charged an annual membership fee unless they use it once a year

- 5-3. No domestic travel insurance

- 6. Some au PAY cards include gold cards

- 6-1. au PAY general cards and gold cards Thorough Comparison

- 6-2. Advantages and Disadvantages of au PAY Gold Card

- 6-3.

- 7. How to earn points smartly

- 7-1. New membership campaign and usage benefits

- 7-2. Get points by opening an au Jibun Bank account < li>7-3. How many points can I actually earn?

- 8-1. Top up au PAY balance

- 8-2. Use to purchase additional au usage charges and data volume

- 8-3. Use to pay for au PAY card

- 8-4. Use for online shopping

- 8-5. Use for digital content

- 8-6. Use for purchasing mobile devices, repair fees, and optional accessories

- 10-1. au PAY Card Application Conditions

- 10-2. au PAY Card How difficult is the card review?

- 10-3. How to apply for an au PAY card

1. The au PAY card is a convenient card with a high return rate! A must-have item for au users even more deals

Is the au PAY card a credit card for au users?

The au PAY card is a credit card that non-au users can apply for. This card is especially recommended for au users because the annual fee is waived for au users.

(Quote: au PAY card official website)The au PAY card is a high return rate card that earns 1% points for everyday shopping. If you charge your au PAY balance, you will get a 1% return, and if you add the code payment, you will get an additional 0.5% points, and you can earn as many as 1.5% points.

You can earn "Ponta points" by using the au PAY card, but there are various partner stores such as convenience stores and supermarkets nearby, making it easy to save and use. You can also charge au PAY and expand the usage even further.

The au PAY card, which has a high return rate and is easy to accumulate points, is also a popular credit card that waives annual membership fees for au users. In addition, the extensive supplementary insurance such as "shopping safety insurance", which is rare for general cards, and "overseas travel safety insurance" is also attractive.

2. What are the features of the au PAY card?

What exactly is an au PAY card?

With the au PAY card, Ponta points can be accumulated at a high return rate of 1.0%. In addition, it is also recommended as a main card because it supports smartphone payments and comes with a full range of incidental insurance.

The au PAY card is a credit card issued by "KDDI Corporation" and "KDDI Financial Services Corporation". Originally, the card was limited to au users, but from May 21, 2020, it became available to non-au users, and the benefits have been changed to make it easier to use.

No annual fee This card has many advantages for au users.

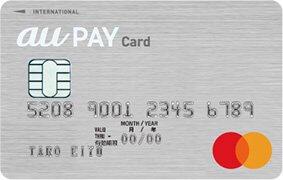

(Quote: au PAY card official website) Click here to apply for au PAY cardThe basic information of au PAY card is summarized in the table below.

[Basic information of au PAY card]

| Items | Details |

|---|---|

| Annual fee | Generally free (If you do not meet the conditions, 1375 yen) |

| Application conditions | Over 18 years old (excluding high school students) |

| Point service | Ponta points |

| Normal return rate | 1.0% |

| Return Rate increase example | ・Refund rate 1.5% by charging to au PAY balance and au PAY (code payment) ・Increase 1 point or more for every 200 yen at point advantage stores ・Shopping at au PAY Market |

| Redeemable Miles | - |

| Point expiration date | |

| td> | One year after points are added for final use |

| Supplementary insurance | ・Overseas travel insurance ・Shopping insurance |

| Additional cards | ・ETC card・Family card |

| Electronic money function | - |

| Smartphone payment | ・au PAY・Apple Pay・Rakuten Pay |

| International brands< /td> | ・VISA・Mastercard |

| Issue speed | Card issuance in as little as 4 days |

| Closing date/Payment date | Closing on the 15th of each month/Payment on the 10th of the following month |

3. au PAY This card is recommended for these people!

What kind of people use au PAY cards?

The au PAY card is especially used by au users because it has many points that au users can benefit from. It is also recommended for those who want to save Ponta points by paying utility bills.

The au PAY card is especially recommended for the following people.

In addition to the annual membership fee being free for au users, you can earn points for the au services you normally use and for everyday shopping. Also, if you use au PAY (code payment), the return rate will be 1.5%, and points will be returned even when paying utility bills.

4. Benefits of the au PAY Card

What are the attractions of the au PAY Card?

The advantage of the au PAY card is that it is easy to accumulate points, such as au users earning points by paying mobile phone bills, and points are always 1.5% or more at point-earning stores, including non-au users. One of the attractions is that there is no annual fee for au users, and even if you are not an au user, you can use it once a year.

The au PAY card has the following advantages.

I will explain the points of each merit in detail.

The au PAY card is a credit card with no annual fee. If you are an au user, the annual fee is free, but even if you are not, you can keep the annual fee free by using it at least once a year.

If you do not meet the conditions, the annual membership fee is 1375 yen. In addition, if the principal member does not meet the conditions, the family card annual fee of 440 yen will be charged to the principal member.

It's not completely free, but if you use it even once a year, the annual fee will be free, so it's not a big problem.

au mobile phones (smartphones, tablets, mobile phones, Wi-Fi routers, etc.) linked to the au ID registered on the au PAY card, au Hikari, au Hikari Chura, UQ mobile, povo1.0, povo2. If you do not have a 0 contract and do not use the card for a year (*), an annual fee of 1,375 yen (tax included) will be charged. Please check the au PAY card site for details. (*) Various fees (ETC issuance fee, usage statement sending fee, late payment fee, etc.) are not included in usage.

Quote: au PAY card official website

The point service Ponta points are easy to use, and the advantage is that they are easy to accumulate with "1 point returned for every 100 yen used". Use your au PAY card for everyday shopping and earn points. Accumulated Ponta points can be used at a rate of 1 point = 1 yen.

As of May 1, 2021, Ponta points will have 250,000 affiliated stores, and can be used in a wide range of genres, including convenience stores, supermarkets, drug stores, and restaurants such as Lawson and Life. is characterized by It is unlikely that you will be in a situation where you have no use for the points you have accumulated, and you will be able to use them on a daily basis.

(Quote: au PAY card official website)Although it is a card with a high return rate of 1.0% normally, if you use au PAY balance and au PAY (code payment) together, the return rate will increase to 1.5%. is a great deal. If you charge your au PAY balance from your au PAY card, you will earn 1 point for every 100 yen, and you will earn 1 point for every 200 yen you pay with au PAY (code payment).

Au PAY (code payment) can be used at a wide range of stores nationwide, including convenience stores, cafes, supermarkets, and drugstores. . In addition to being able to increase points, it is attractive that you can easily make cashless payments with your smartphone without showing your credit card.

| Card name | auPAY card | d card | Rakuten card | Annual fee | Free | Free | Free |

|---|---|---|---|

| Return rate | 1.0%~2.5% | 1.0%~4.5% | 1.0%~3.0% |

| International brand< /th> | VISA/Mastercard | VISA / Mastercard | VISA |

| Issue speed | Minimum 1 week | Minimum 5 business days | Minimum next business day |

| Additional insurance | Overseas travel /Shopping | Shopping | Loss/Theft Protection/Travel Support |

| Additional Card | ETC Card/ Family card | ETC card/Family card | ETC card/Family card |

au online shopping site If you select au PAY card as the payment method at "PAY Market", the point return rate will be +5%. In addition, au users can choose from either "au usage fee discount of up to 10% discount + point redemption of up to 2%" or "point redemption of up to 16%" and enjoy shopping at a great price.

Even non-au users can use the "shopping benefit program" to receive up to 16% point reduction, which is very profitable.

"au PAY Market" handles a wide range of genres such as food, fashion, books, and home appliances, and offers services with many merits such as discount coupons and point rewards. Even during times when it is difficult to go out due to the corona crisis or when you are busy, you can easily shop using the online shopping site.

If you use your au PAY card at point-up stores, you will always earn 1.5% or more points. For example, at Seven-Eleven, for every 200 yen spent, Ponta points will be increased by 1 point, and when combined with regular points, you will earn 3 points. The following is a summary of the main “point-up stores” where the point return rate is always 1.5% or more.

| Partner store name | Additional points for every 200 yen | Remarks |

|---|---|---|

| Seven-Eleven | 1 point | Convenience stores nationwide |

| Ito-Yokado | 1 point | Super |

| York | 1 point | Super |

| York-Benimaru< /td> | 1 point | Super |

| Toho Store | 1 point | Super< /td> |

| Mega | 2 Points | Drugstore |

| Thank You Drug | td>2 points | Drugstore |

| Nojima | 1 point | Digital network specialty Store |

| Starbucks | 3 Points | Coffee Store |

| Kappa Sushi | 2 points | Restaurant |

| Conveyor belt sushi Seijiro | 2 points | Restaurant |

| Family Restaurant Cocos | 2 points | Restaurant |

| 2 points | Restaurant | |

| Northern taste travelogue and local sake Hokkaido | 2 points | Restaurant |

| Domino Pizza | 2 points | Restaurant< /td> |

| FAST NAIL | 2 Points | Nail Salon |

| Yamato | td>2 points | Department store |

| BIG ECHO | 2 points | Karaoke store< /td> |

| Sports Pro Shop B&D | 2 Points | Sports Shop |

| TOHO Cinemas | 2 points | Movie theater |

| Kinokuniya Bookstore | 2 points | Bookstore |

| Orix Rent-A-Car | 2 Points | Car Rental Agency |

| Art Moving Center | 2 points | Movers |

| IDEMITSU | 1 point | < td>Gas Station|

| Yuzawaya | 2 Points | Hobby Material Specialty Store |

| Acquisition tactic | 2 points | Taxi company |

| Joshin Denki | 1 point< /td> | Electronics mass retailers |

You can efficiently aim for points up at a wide variety of stores such as convenience stores, supermarkets, drug stores, and restaurants. Check the latest list to see if the store you usually use is a "point-up store".

By paying monthly mobile phone bills and utility bills with an au PAY card, you can aim for even more stable points. For example, if you combine your electricity, gas, water, broadcasting, mobile phone, and landline payments into an au PAY card, you will not only earn points for monthly payments, but it will also be easier to manage.

If you use a fixed-line communication service such as au mobile phone or "au Hikari", you will be eligible for "Monthly Points" where you can earn 10 points for every 1000 yen, and you can earn double points. Also, if you apply for "au Denki", you will receive up to 5% of Ponta points according to your monthly electricity bill.

| Monthly electricity bill | Point addition rate |

|---|---|

| Less than 5000 yen | 1%< /td> |

| 5000 yen to less than 8000 yen | 3% |

| 8000 yen or more | 5% |

The au PAY card also has the advantage of being able to create family cards and ETC cards for free. As with the main member, the family card has no annual fee if you are an au user or use it at least once a year. If the primary member incurs an annual membership fee, 440 yen will be charged for each family card.

In addition, one ETC card can be issued for each au PAY card. There is no annual fee, and if you use it within one year of issuance, a new fee of 1,100 yen will be deducted and it will be virtually free.

au PAY card comes with the following insurance.

・Shopping safety insurance (with usage) ・60-day theft/loss compensation ・Overseas travel safety insurance (with usage)

I will explain the details of the supplementary insurance.

"Shopping Anshin Insurance" is an insurance that compensates for damage, theft, etc. for 90 days when using your au PAY card to shop in Japan and overseas. Compensation is summarized in the table below.

| Payment limit | 1 million yen per year |

|---|---|

| Deductible amount | 3000 yen |

| Collateral period | 90 days from the date of purchase |

| Scope | Domestic/Overseas |

Even if you drop and break the item you purchased, or if it is lost due to theft, you will pay 3,000 yen and pay 100 yen per year. You can receive compensation up to 10,000 yen.

If your card is lost or stolen, you will receive 60 days of theft compensation. Even if it is used illegally, you can rest assured that you will be compensated retroactively for 60 days from the date you reported the loss or theft.

If your card is lost or stolen, report it to the nearest police station and contact your credit card company as soon as possible. Please note that if there is no signature on the back of the card, the coverage may not apply.

If you pay overseas travel expenses in advance with your au PAY card, you can use "Overseas Travel Anshin Insurance". You can get generous compensation for accidents during your trip, up to 3 months from the time you leave your home for overseas travel to the time you return.

| Injury death/disability | 20 million yen |

|---|---|

| Injury treatment costs | 2 million Yen |

| Illness treatment costs | 2 million yen |

| Rescuer costs, etc. | 2 million yen |

| Personal Liability | 20 million yen |

| Luggage damage (Deductible amount 3,000 yen) | 200,000 yen |

Even if you are sick or injured while traveling abroad, medical expenses and hospitalization expenses will be compensated. . Even if you accidentally damage the fixtures and facilities of the hotel you are staying at, or if your camera or bag is stolen, you can rest assured that you will be covered by the insurance that accompanies the use.

By using the convenient members-only site, you can collect necessary information and perform operations 24 hours a day. For example, you can check and download billing amounts and usage details for the next and past 14 months.

You can also check the current available amount and change the payment method after shopping. You can also manage Ponta points and use them for payments.

A convenient member-only site that can be used 24 hours a day is a great advantage for making good use of the au PAY card.

By downloading the au PAY app, you can use your au PAY card more conveniently. By using the app, you can perform the following operations using your smartphone.

The au PAY app can be downloaded for free from the App Store and Google Play. It is convenient and easy to manage your spending because it automatically sorts your shopping details by genre and brand.

5. Disadvantages of au PAY Card

What kind of people are not suitable for au PAY Card?

The disadvantages of the au PAY card are that it does not support touch payments and that it does not include domestic travel insurance. It may not be recommended as a main card for those who value contactless shopping or those who want to enhance domestic travel insurance.

The au PAY card has three major disadvantages.

I will explain the disadvantages of each in detail.

A disadvantage of the au PAY card is that it does not support "touch payment". "Touch payment" is a contactless payment service that allows you to pay by simply holding your credit card over it, and it can only be used at stores with the touch payment compatible mark.

Since the au PAY card does not support touch payment, it is a disappointing point for those who feel the merit of being able to shop without contact.

The number of card companies offering contactless payment services is increasing, and it is expected that au PAY cards will also be introduced in the future. Until then, it would be a good idea to actively use smartphone payments (QR code/contactless) such as "au PAY" and "Apple Pay".

The au PAY card has no annual fee for au users, but non-au users will be charged an annual fee of 1375 yen if it is not used once a year. The annual membership fee for the family card is also free in principle, but if the main member incurs an annual membership fee, an annual fee of 440 yen will be charged for each family card.

However, it is not difficult to take measures because the hurdle for the condition itself is low, such as "use once a year". For example, you can easily clear the annual fee free condition by paying your utility bills with a credit card.

The au PAY card comes with plenty of supplementary insurance, but please be aware that there is no domestic travel insurance. If you have many opportunities to travel domestically, you may want to use a card that includes domestic travel insurance.

The number of cards with no annual fee and domestic travel insurance is limited, but that doesn't mean they don't exist.

However, health insurance is available in Japan, and it is thought that there are few cases where treatment costs will be higher than when traveling abroad. So even if you don't have domestic travel insurance, it shouldn't be too much of a problem.

If you want to be fully prepared for any trouble, it is a good idea to join the insurance company's "Domestic Travel Accident Insurance".

6. There are Gold Cards for au PAY Cards

Are there Gold Cards for au PAY Cards?

The au PAY card also has a gold card. The au PAY Gold Card has an annual membership fee of 11,000 yen, but there are many benefits such as a higher point return rate and additional insurance coverage than a normal au PAY card. The au PAY Gold Card has an annual fee, so it is important to make full use of the points that can be accumulated at great value.

(Quote: au PAY Gold Card Official Site) Click here to apply for an au PAY CardThere are also Gold Cards that come with even more generous insurance and benefits. Here, we will compare the gold card and the general card and explain which one is more profitable. If you are considering a gold card, please refer to it.

First, compare the basic information of the au PAY general card and the gold card.

| Item | au PAY Card | au PAY Gold Card | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annual fee | Free | 11,000 yen | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Application requirements | Age 18 or older *Except high school students | Over 20 years old *excluding students, unemployed, part-time workers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Membership benefits | A total of up to 10,000 points will be given when the benefits are met. | A total of up to 20,000 points will be given when the privilege conditions are met | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Membership benefits service | - | ・100 points will be returned for every 1,000 yen used for monthly au communication charges and fixed lines such as au Hikari ・If you charge your au PAY balance from your au PAY Gold Card, you will receive 1% Ponta points, 1% regular points and au PAY code payment 2.5% reduction combining 0.5% ・Up to 18% point reduction for shopping at au PAY Market | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional insurance | ・Overseas travel insurance : Up to 20 million yen ・Shopping safety insurance: up to 1 million yen per year | ・Overseas travel safety insurance: up to 50 million yen ・Domestic travel safety insurance: up to 50 million yen ・Shopping safety insurance: up to 50 million yen Up to 3 million yen | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Travel Benefits | - | ・Free airport lounges at major domestic airports and Hawaii ・First-class hotels and Privilege services at inns ・Privilege car rental services ・Overseas assistance services (Hello Desk)

au PAY card Use of "Overseas Travel Anshin Insurance" is included. On the other hand, the au PAY Gold Card's "Overseas Travel Anshin Insurance" is automatically included, and "Domestic Travel Anshin Insurance" is included. Click here to apply for an au PAY cardThe au PAY Gold Card offers generous benefits compared to regular cards. The advantages and disadvantages of the au PAY Gold Card are summarized below. Which is better, the au PAY card "general card" or "gold card"? What I would like to pay attention to as a judgment criterion is whether the benefits of the gold card annual fee of 11,000 yen or more can be obtained. For example, the gold card has a point reduction rate that makes it easy to accumulate Ponta points. What I would like to pay particular attention to is that 11% of the usage fee will be returned as points for au mobile charges and "au Hikari". If your monthly au mobile phone bill and au Hikari usage fee is 10,000 yen, you will receive 13,200 points per year with the gold card (1,200 points per year with the regular card). In other words, you can see that there is a merit that exceeds the annual fee of the gold card, and it is profitable. Also, if you meet the conditions, you can get up to 20,000 points for gold cards and up to 10,000 points for general cards, and gold cards can cover the annual fee for the first year. As a condition for applying benefits, you must first set up to receive campaign emails and register a credit card payment account. After that, 10% (maximum 7500 points) will be added to the au PAY balance, 5% (maximum 7500 points) will be added for shopping, and 5000 points will be added for paying utility bills or issuing and using a new ETC card. Additionally, if you plan to take advantage of the exclusive benefits of a Gold Card every year, the Gold Card may be a better deal. For example, "those who travel every year and use airport lounges", "those who travel a lot domestically and may benefit from incidental insurance". 7. Save even more! Smart ways to earn pointsHow can I save au PAY card points? In addition to the new enrollment campaign, you can continue to save points by paying your utility bills and au mobile phone bills with credit. If you take advantage of the au PAY card new membership campaign and usage benefits, you can earn even more points. As of November 29, 2021, a total of up to 10,000 Ponta points will be presented as "new enrollment & usage benefits". Benefits and applicable conditions are as follows. Benefits 1 and 2 are valid until the end of the 3rd month including the month of enrollment, and benefit 3 is valid until the end of the 6th month. If you plan to make a large purchase after joining the card, you can aim to increase points at once by using the new membership campaign and usage benefits. In addition, in the case of a gold card, you can get a chance to earn up to 20,000 points, which is advantageous because it covers the annual fee for the first year. If you open a new au Jibun Bank account and change the au PAY card withdrawal account to au Jibun Bank, you will receive Ponta points according to the transaction conditions. The applicable conditions and benefits as of November 29, 2021 are as follows. [Total up to 1200 points gift for clearing the required conditions] ・Conditions of application Change the account from which au/UQ mobile usage charges or au PAY card usage charges are debited to an au Jibun Bank account. First, open a new au Jibun Bank account, log in to the au Jibun Bank official website, and then register your "au ID". After that, apply for "Discount with au Jibun Bank Points" and the condition will be cleared when the payment is debited from your au Jibun Bank account. ・Benefits 50 Ponta points will be presented every month for up to 2 years, and you can earn a total of up to 1200 points. If you clear the following transaction conditions (1) or (2), you will receive more points. [Transaction conditions 1] If you charge your au PAY balance from your au Jibun Bank account, you will receive 50 Ponta points every month for up to 2 years, and you can earn a total of up to 1200 points. Combined with the benefits of clearing the required conditions, you will receive a maximum of 2,400 Ponta points in two years. [Transaction conditions 2] If you meet one or more of the following conditions, you will receive 150 Ponta points every month, and you can earn up to 3,600 Ponta points in total for up to two years. When combined with the benefits of clearing the required conditions, you can earn up to 4800 points in two years. In addition, if both transaction conditions (1) and (2) are cleared, the benefits of (2) will take precedence. Let's summarize how many points you can actually earn by using the au PAY card. [For men in their 30s (family of 3)]

In the above case , The total monthly usage fee for the card is 100,000 yen. Earn 1525 points per month, for a total of 18,300 points for the year. If you use your au PAY card for everyday shopping and actively use points-up stores, you can earn a large amount of points over the course of the year. Furthermore, if you pay for your child's mobile phone or leisure expenses such as family trips with a credit card, you will be able to earn more than 20,000 yen worth of points per year. Compared to cash payment, you can see that the au PAY card, which has a high return rate, can save nearly 20,000 yen a year with points. Using the au PAY card, which has a high return rate, not only saves on living expenses, but also has many benefits such as making it easier to manage your household finances. 8. Smart use of accumulated pointsWhat can I use my au PAY card points for? Accumulated points can be used in a variety of ways, such as charging your au PAY balance, paying au usage fees, and paying au PAY cards. In particular, you don't have to worry about points expiring because you can use them to pay for your au PAY card. The Ponta points accumulated by using the au PAY card can be used as 1 point = 1 yen. The expiration date is ``one year after the last use of points'', so if you use it every month to pay utility bills, etc., you do not need to worry about points expiring due to expiration. Here are some smart ways to use your accumulated points. The Ponta points accumulated by using the au PAY card can be charged to the au PAY balance at the rate of 1 point = 1 yen. The total amount that can be charged is up to 20,000 yen per month, and there are no fees. You can receive a 1% point return by charging, and 0.5 points are accumulated for every 200 yen with au PAY (code payment), so the total point return rate is 1.5%, which is very profitable. As of November 2021, au PAY (code payment) will be supported by 4.53 million points and payment merchants, so you will have no trouble using it. You can also top up your au PAY balance from your au PAY card. First, download and launch the "au PAY app", then tap "Charge" → "au PAY card". Enter the amount to be charged, tap "Charge", enter the 4-digit PIN set at the time of contract, and tap "Pay" to complete charging. You can use it even more conveniently by setting "Auto Charge" to automatically charge the insufficient amount. The accumulated Ponta points can be used to purchase additional au usage charges and data capacity. For au usage charges, access the au PAY app and log in with your au ID and password. Please choose from the following three courses and apply. If you want to purchase additional data capacity with a data charge, please follow the procedure from the "data charge site". If you check the charge plan, charge timing, and number of charges, and set the payment method to "au Easy Payment", you can either apply all Ponta points or specify the number of points. It is also possible to apply Ponta points to the estimated billing amount of the au PAY card. Assuming that 1 point is equivalent to 1 yen, you can use up to 20,000 points per month in units of 100 points. Tap "Ponta points" → "Pay with points" on the site for au PAY card members, select the amount you want to use, and tap "OK" on the confirmation screen to complete the procedure. It is possible to use Ponta points at the same time as shopping, but if you pay with points later, points for the purchase amount paid by card first will be added, which is advantageous. For example, if you want to use 2000 points for 10,000 yen shopping, if you use points on the spot, points will be added for 8000 yen. On the other hand, if you use points when billing your card, points will be added for 10,000 yen, and there will be a difference of 20 points. The accumulated Ponta points can also be used for online shopping. au PAY Market, the au official general mail order site, is an online shopping site that boasts a lineup of over 50 million items, and you can pay for all or part of your purchases with Ponta points. At au PAY Market, you can not only use points, but you can also aim for points up with up to 16% point reduction, and you can use coupons to make great shopping. Surplus Ponta points can be used to purchase digital content through "au Easy Payment". For example, you can purchase new movies and dramas (around 500 points per movie) at "TELASA" and watch them on your TV or computer. In addition, you can purchase popular comics, practical books, and novels (each comic has around 400 to 500 points) on "Book Pass" and read them on your smartphone. You can also download and listen to music (around 270 points per song) from the "Music Store". It is also possible to use Ponta points when purchasing mobile devices, repair fees, and purchasing optional items. With the exception of some products, Ponta points can be applied to payment and shipping costs at the time of purchase at the "au Online Shop". Since it can be used in units of 1 point, it is convenient to use up even a small amount of points without wasting them. 9. Reviews of au PAY CardsWhat is the reputation of people who actually use au PAY cards? Many people who use the au PAY card mainly feel the benefits of the high return rate of points and use it. Please refer to the following reviews and consider applying while checking whether it is suitable for you. Here are reviews from people who actually use the au PAY card. Overall, there are many reviews about points, and not a few people feel the benefits of a high return rate. ・I made an aupay card, so I charged aupay with 35,000! Get 3500 Ponta Points ・auPAY is usable in many places ・Buying alcohol at Beisia is a relatively large load. Dodosco can also use auPay card (MasterCard), so it's convenient to save Ponta. ・Since the aupay card has arrived, I immediately charge it to aupay and set up the utility bill payment. I'll take your points. (Original mom) 10. How to get an au PAY cardWhere should I apply to get an au PAY card? You can apply for an au PAY card online. Please make sure that you meet the eligibility criteria before applying. The au PAY card is recommended not only for au users, but also for those who want to save Ponta points and use them at great value. Here, we will explain the application conditions, examination, and application method, which are of concern when actually making a credit card. The au PAY card is a credit card that can be applied for by a relatively wide range of people, including students and housewives, who are 18 years of age or older, excluding high school students. The specific application conditions are as follows. ・Customers with an au ID for personal use (you cannot apply with an au ID used for a corporate contract)・Those aged 18 or over, excluding high school students・You or your spouse・Customers who have not yet contracted au PAY Smart Loan (formerly au WALLET Smart Loan) *Students can apply regardless of whether they have regular income. *Minors need parental consent. Quote: au PAY card official website Family cards can be issued free of charge, but the following application conditions must be met. ・Family members can apply from the "members-only site" ・Using an au mobile phone (smartphone, tablet, mobile phone, Wi-Fi router, etc.) or UQ mobile in the name of the family member applying Must be used ・Family members aged 18 or over (excluding high school students) *If the primary member is a student, a family card cannot be issued. Quote: au PAY card official website The au PAY card is subject to screening just like other credit cards, and will not be issued unless it passes the screening. The application conditions state that "spouse with regular income" and "students with or without regular income" can apply, so the examination difficulty is not so high. However, in credit card screening, the credit information of the applicant is checked by the credit information agency. Those who have had a financial accident in the past, or who have problems with mobile phone payments, are highly likely not to pass the screening. A credit information agency is an institution that manages and provides credit information registered by member companies. Credit companies and loan companies check the credit information of consumers registered with credit information agencies as one of the materials for judging the creditworthiness of consumers. Credit information is information about credit and loan contracts and applications, and is personal information that has registered objective transaction facts. It is used as a reference material for credit companies and loan companies to judge the "credit" of customers. In the examination, there is no special consideration for au users, such as "the longer the au contract period is, the more advantageous it is in the examination". Similar to general credit card screening, if you can prove that you have the ability to repay and there are no problems such as financial accidents, the chances of you failing the screening are not high. If you are worried about the screening, you should take various measures such as setting the cash advance limit to zero or not applying for multiple credit cards at once. The cash advance usage limit is the maximum amount that you can borrow cash using the cash advance function of your credit card. Many credit cards have a "shopping credit limit" that can be used for payments, and a "cash advance credit limit" that allows you to borrow cash from ATMs and receive money transferred to your account. As for the application method for au PAY card, proceed with the following 6 steps. Step 1. Access the "Enrollment application" page on the official website from a computer or smartphone, check the membership agreement, etc., and then click "Agree." Step 2 Log in with your au ID to confirm your au contract. Step 3 Enter "Customer Information" and select ETC card or family card. Prepare a passbook or cash card to register a payment account. Step 4 After completing the application, you will receive an application receipt email. Step ⑤ Screening and issuing procedures are carried out, but you may receive a phone call for confirmation. You can check the screening results on the Screening Result Inquiry Screen, and a notification of completion of screening will be sent to your registered email address. Step ⑥ After applying, the card will be issued in as little as 4 days. 11. Points to note when canceling an au mobile phoneWhat will happen to my au PAY card if I cancel my au contract? You can continue to use the au PAY card, but you will lose benefits such as high point rewards when paying au mobile charges. When au PAY card users cancel au, it is important to fully understand the disadvantages. You may consider canceling your au mobile phone and switching to another company while using your au PAY card. In this case, can I continue to use my au PAY card? In conclusion, even if you cancel your au mobile phone, you can still use your au PAY card. However, if you are not an au user and do not use the card for a year, you will be charged an annual membership fee of 1375 yen for the following year. In addition, if the primary member's card incurs an annual fee, the annual fee of 440 yen per family card will be borne by the primary member. 12. Q&A about au PAY CardFinally, here are some frequently asked questions about au PAY Card. If you are considering applying for an au PAY card, please refer to it. 13. SummaryWe have summarized the features and benefits of the au PAY card. The au PAY card has a "normal return rate of 1%", making it easy to accumulate points, and the accumulated Ponta points can be conveniently used at a rate of 1 point = 1 yen. For au users and those who use the card more than once a year, the annual membership fee is always free, so it is recommended. There are many ways to increase your points, such as paying au mobile phones and utility bills, charging your au PAY balance and paying with codes, and point-up stores. This credit card is perfect for those who want to earn points and manage their finances.

|